THE OPTIONS WHEEL STRATEGY • TRAINING COURSE & TRADING TOOL

What is “The Wheel” Options Strategy?

Discover why so many traders are now using this options trading strategy.

A simple options strategy with big results

“The Wheel” options strategy explained

The wheel strategy is a simple yet effective options trading strategy. You can earn good profits with a higher probability of success and lower risk than other option strategies.

Basic options principles

A stock option is a contract between a stock investor and the seller of the option contract. Think of it as an insurance contract – the investor buys insurance from the options seller to protect his position if the price of some stock he holds crashes. If the stock price drops below the level agreed in the contract, the options seller must buy the stock away from the investor at the agreed upon price and date.

For example, Cathy is an investor. She buys 100 shares of Kitten Socks Company, Inc at $60 per share. She is worried that some bad news affecting the company might have an adverse affect on her investment. She has heard a rumor that cotton production will fall sharply next year, causing a supply issue which in turn will increase the price of cotton. She decides to contact Bob, an options seller.

They agree that if the stock price of Kitten Socks Company, Inc falls below $40, 60 days from now, he will buy the stock from her at $40, whatever the price it is at that time. Bob charges Cathy a “premium” of $125 for this insurance contract.

60 days later, the cotton production rumor turned out to be false news. Kitten Socks Company, Inc has reported stellar sales and profits and the stock price has risen to $90. Cathy is happy. Her investment was safe and she’s now holding a profit of $3,000, albeit at a small insurance cost of $125 – a small price to pay for the piece of mind she had received. Bob, the option seller, is also happy – he made a profit of $125 for doing nothing other than wait for the 60 days to be over!

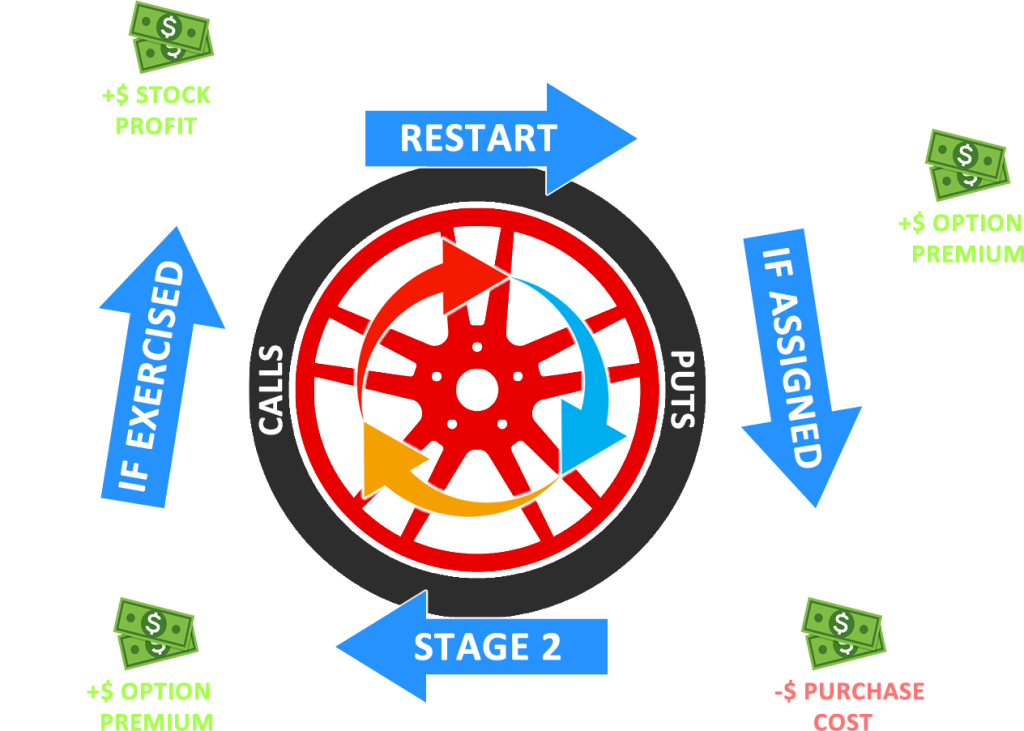

The wheel strategy is an options trade strategy where YOU are the OPTIONS SELLER – yes, you sell insurance to investors! You make money from the premium you receive from the option contracts you sell to investors.

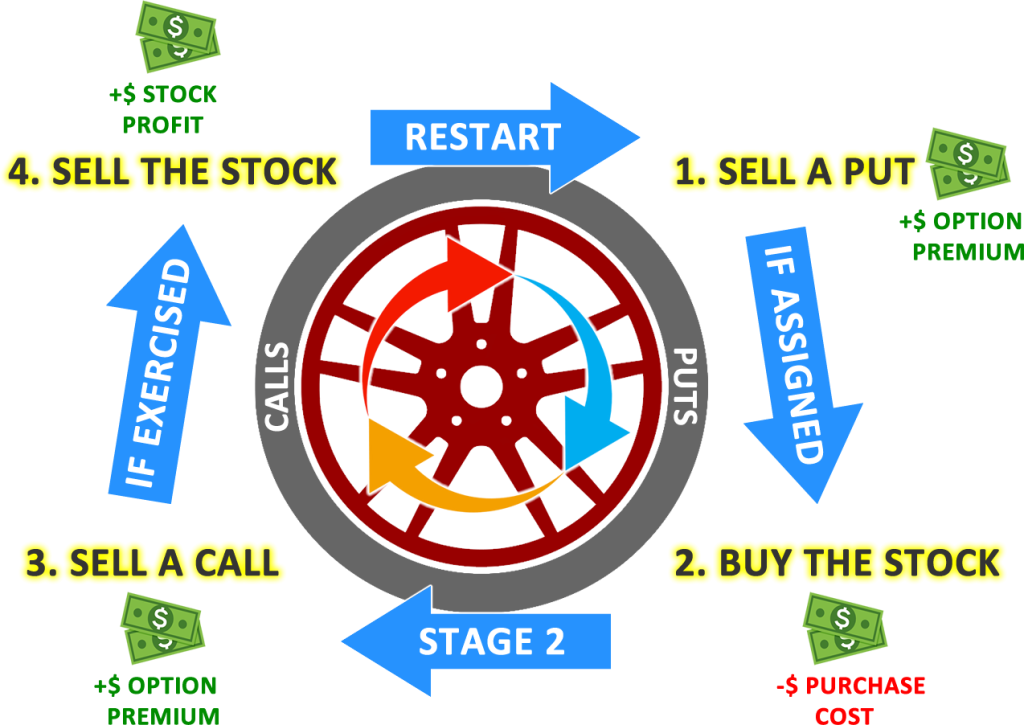

The options wheel STRATEGY

How it works

Let’s look at the main concepts of trading options using “The wheel” strategy.

STAGE 1. SELL A PUT → You sell a “put” options contract to an options buyer

There are two types of option contracts, PUTS and CALLS. A put option is a contract giving the buyer the right, but not the obligation, to sell a stock at a predetermined price within a specified time frame. In STAGE 1 you are going to sell a put option to a buyer. Each option contract you sell is for 100 shares of the underlying stock.

So, you start by selecting a stock that you would like to own at a discounted rate. For example, you’d really like to buy 100 shares in Rubber Duck Company, Inc because you believe the company will grow and prosper and its stock price will rise over time.

At the moment its stock price is $110 per share. Not a bad price, but you’d be even happy buying it at $90! Who wouldn’t want a discount like that?!

So you log into your broker’s account trading console to set up the trade. You decide to sell one put contract for $90 (known as the strike price) with an expiration date three months from today. For that trade, you can receive a premium of $115.

This means, if someone buys your options contact they will pay you $115 of premium which you keep regardless of the final outcome of the trade – nice! If the price falls below $90 after 3 months, you will have to buy their 100 shares of Rubber Duck Company, Inc, with the cost to you of $90 per share. You would therefore end up buying 100 shares x $90 strike price = $9,000. However, if the stock price of Rubber Duck Company, Inc remains above $90 you do not buy the shares, but you still keep the $115 premium – nice again!

So you enter the following trade in your broker’s trading console …

Rubber Duck Company Inc – 3 months expiry – $90 strike price – PUT – Sell to open – $115 premium

… and click the SELL button. BANG! Almost instantly someone buys your contract and your account is credited with $115 premium – you’ve just made money!! Now you sit on your hands and wait for 3 months …

… 3 months later … one of two outcomes is possible:

Outcome #1: the stock price closes above your strike price of $90 – for example, the stock on the final day of trading closed at $98. Over the three months of your options contract it fell a bit from $110, but it is still above your $90 strike price. Therefore, the buyer keeps the shares of Rubber Duck Company, Inc and you walk away with the $115 in your pocket (actually your broker’s account) – Ka-Ching! You can now go and sell another put on the Rubber Duck Company, Inc and make more premium! This takes you back to the beginning of STAGE 1 of the wheel strategy.

Outcome #2: the stock price closes below your strike price of $90 – for example, the stock on the final day of trading closed at $87.

Now you move onto STAGE 2 of the wheel strategy.

STAGE 2. BUY THE STOCK → You buy the shares of the underlying stock from the options buyer

Oh no! You have to buy the 100 shares at a terrible price, $3 lower than your strike price, right? WRONG! Ok yes, you do have to buy the shares at $90 (100 shares x $90 = $9,000 in total) BUT this is a stock you wanted to buy and 3 months ago you it would have cost you $110 per share – so you have now bought the stock at a great discount PLUS you still keep the $115 premium. Nice! You now have some great stock that you are happy to own plus you made some premium cash on the side!

Over the weekend your broker arranges the purchase of your 100 shares. On Monday morning you check your broker’s account you see you are now the proud owner of 100 shares of Rubber Duck Company, Inc. Wow, that’s fantastic! Not only do you own a part of a company you strongly believe in, you also receive all the benefits that a shareholder enjoys, including collecting dividends (more cash on the side!) and voting rights at the annual shareholders meeting!

Your bathtub rubber duck has taken on a whole new meaning! Things couldn’t get any better, right? Actually, they can – move onto STEP 3 of the wheel strategy.

STAGE 3. SELL A CALL → You sell a “call” options contract to an options buyer

The second type of option contract is a CALL option. A call option is a contract giving the buyer the right, but not the obligation, to buy a stock at a predetermined price within a specified time frame. In STAGE 3 you are going to sell a call option to a buyer. Each option contract you sell is for 100 shares of the underlying stock.

So as an option seller you are interested in making money from premiums when selling option contracts. You did this in step 1 by selling a put and now you can do this again by selling a call. Let’s make some more money!

Surprising, there are plenty of people out there who want to buy all your 100 Rubber Duck Company, Inc shares from you … but not at the current price – at a higher price at some point in the future – crazy right?! And they’ll even pay you premium for it! Why would they do such a thing? Wouldn’t they be better off buying the shares now at the current price? Possibly, but they are hedging their bets. They don’t want to buy shares of a company and then the share price drops and the stock loses value. They want a guarantee that the stock stock price is on the way up, so they’ll wait and buy in when its on the up. This is fine with us – we want to earn money from premium, and hey, if they want to buy our stocks at a higher price, we’ll happily profit off that too!

So you open up your broker’s trading console and select a strike price and expiry date for your stock. You decide upon the following:

Rubber Duck Company Inc – 3 months expiry – $95 strike price – CALL – Sell to open – $126 premium

As you can see, the amount of premium will earn for this trade is $126. You pull the trigger and within seconds … BANG! SOLD! Your account has been credited $126 and you still own the stock. Now you have to wait it out again …

… 3 months later … one of two outcomes is possible:

Outcome #1: the stock price closes below your strike price of $95 – for example, the stock on the final day of trading closed at $92. Over the three months the stock price has increased from $87 to $92, but it is still below your $95 strike price. Therefore, the you keep the shares of Rubber Duck Company, Inc and you walk away with the $126 – Ka-Ching! You can now go and sell another call on the Rubber Duck Company, Inc and make more premium! This takes you back to the beginning of STAGE 3 of the wheel strategy. You keep selling call options and making premium until the stock finally closes above your strike price.

Outcome #2: the stock price closes above your strike price of $95 – for example, the stock on the final day of trading closed at $98.

Now you move onto STAGE 4 of the wheel strategy.

STAGE 4. SELL THE STOCK → You sell the shares of your underlying stock to the options buyer

You reached the final stage of the wheel strategy (or have you?? More about that later). Congratulations! As per the rules of the call option contract, you have to sell your shares to the option buyer.

And look at your profits of the complete wheel trade!

| Stage 1 – Sold 1 put option | $115 premium |

| Stage 3 – Sold 1 call option | $126 premium |

| Stage 4 – Sold 100 shares | $5 profit on stock price increase x 100 shares = $500 |

| TOTAL PROFIT | $741 |

How good is that?!

But, oh no – you look at your broker’s account portfolio and you’ve gone and sold off all your beloved Rubber Duck Company, Inc shares! All your dreams of future profits and a bathtub full of rubber ducks have been dashed! Well, no, not at all! This is where the wheel turns and you go back to STAGE 1.

You can sell puts again on your favorite stock and if you don’t get the shares back right away, you’ll make money from the premiums you are charging. Then, if you get assigned the stock, you are a shareholder again, and making money again selling call options for premium!

And so the wheel turns!